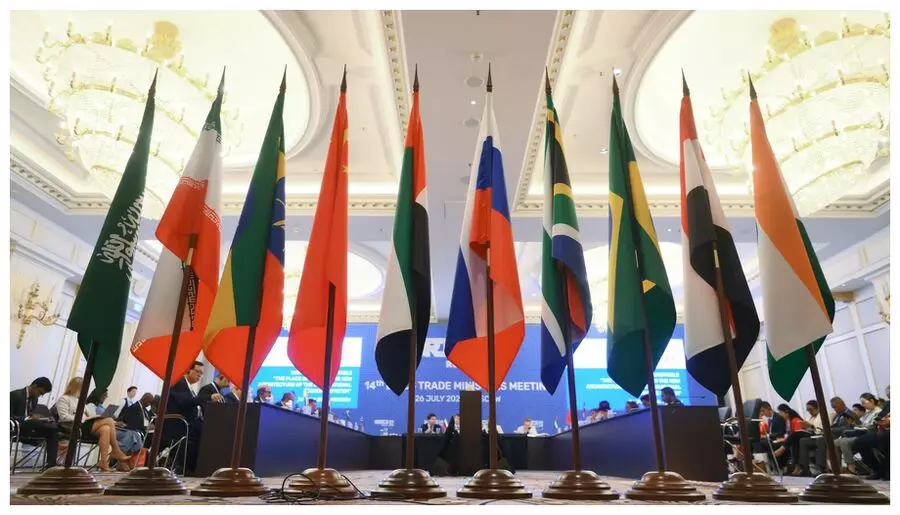

With the 14th BRICS Summit taking place in Beijing, discussions are underway for the creation of an international reserve asset similar to the International Monetary Fund’s (IMF) Special Drawing Rights (SDR. The aim is to reduce dependency on the US dollar and create a more stable economic system.

The proposal comes as part of the BRICS countries’ efforts to establish a more equitable and fair financial system. The idea is to create an institution with the power to issue credit to finance trade and payment deficits among some nations, using a bancor-type SDR. This would be different from a clearing house system for existing banks, as it would serve only as a settlement mechanism among governments, not a generally traded currency.

However, Prof. Michael Hudson, an economist and author of Super Imperialism, argues that the newly created institution should not finance deficits by member countries for such payments, suggesting a moratorium on such payments due to the current weaponization of Western finance. He also recommends that the BRICS bank (the NDB) should not finance deficits by member countries for such payments.

The potential for productive change in the financial system is undeniable, with time running out fast. The focus should be on creating a stable and equitable financial infrastructure that benefits all nations involved. While it may be too soon to introduce a fait accompli at this year’s BRICS Summit, it could serve as a venue to throw open a set of alternatives, including what would happen by ‘doing nothing’ and going with the current IMF system.

The “Kissinger moment” is essential in this equation, highlighting the need for an institution that any nation could call upon for assistance. It remains unclear whether the BRICS Summit will come up with a “BRICS number” anyone could call. However, if the Global South can manage to create and agree on a new financial system, it could be presented as a fait accompli to the superpower whose economy is currently saddled with $35 trillion in debt.