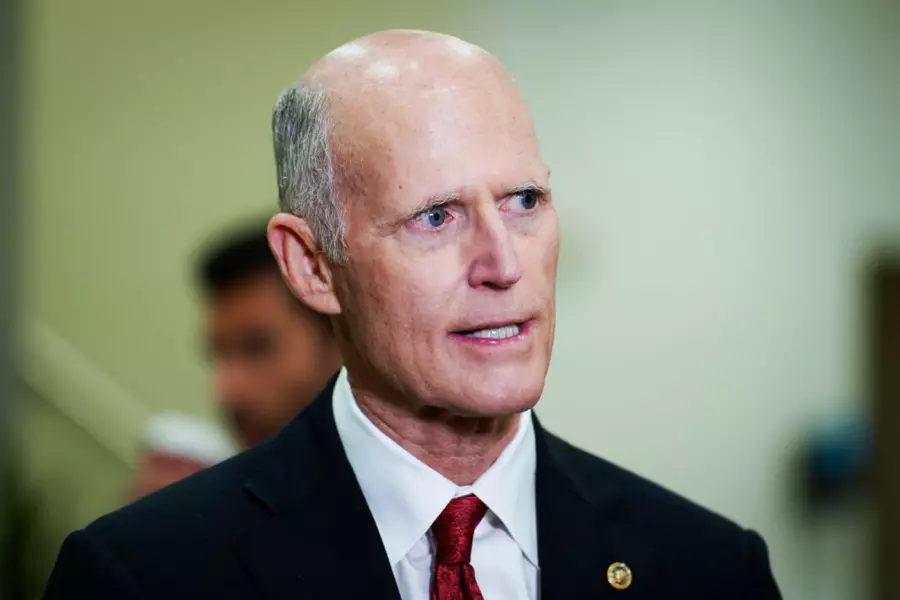

Senator Rick Scott (R-Fla.) has raised concerns about Zeekr, a Chinese electric vehicle maker that recently began trading on the New York Stock Exchange (NYSE. In a letter to Securities and Exchange Commission (SEC) Chairman Gary Gensler, Scott expressed his apprehension about the SEC’s process in determining and adequately disclosing the extent of Zeekr’s ties to the Chinese Communist Party (CCP) regime. He highlighted that China’s authoritarian control over its economy and companies poses significant risks for U.S. investors, making this listing concerning both to the integrity and strength of U.S. capital markets and the protection of American investors.

In his letter, Scott referenced a recent report published by the Senate Finance Committee that revealed some automakers have alarming ties to Chinese supply chains, which are tainted with forced labor and human rights violations. Given Zeekr’s affiliation with the CCP, Scott posed serious questions about whether the SEC can be confident that Zeekr is not utilizing specific supply chains that rely on forced labor.

To address his concerns about inadequate disclosures by Chinese firms to the SEC, Scott noted that he had introduced the Securing American Financial Exchanges (SAFE) Act (S.854) and the Transaction and Sourcing Knowledge (TASK) Act (S.864. These two bills were part of five that Scott introduced in March last year to counteract the CCP’s influence in the U.S. financial sector.

The TASK Act would direct the SEC to disclose the sourcing and due diligence activities of all listed companies involving supply chains that are directly or indirectly linked to products and services utilizing forced labor from the Xinjiang region. Scott urged Mr. Gensler to respond to several questions in a timely manner, including whether Zeekr had received financial support from the CCP, the steps taken by the SEC to ensure Zeekr’s supply chain is free from forced labor and human rights abuses when approving its IPO, and if Zeekr had conducted business with Chinese firms currently on entity lists maintained by the U.S. Treasury, Commerce, and Defense departments.

Furthermore, Scott asked Gensler for assurances that U.S. investors will have adequate legal recourse and protections if they suffer losses due to Zeekr’s actions or those of the Chinese government. In his letter, Scott emphasized the importance of ensuring that U.S. investors are informed about Chinese companies such as Zeekr, stating that it is crucial to ensure that our financial exchanges do not promote U.S. capital investment in firms with ties to countries that aim to destroy America. Such investments would undermine not only national security but also the overall integrity of U.S. capital markets.

Zeekr representatives have yet to respond to a request from The Epoch Times for comment on Scott’s concerns and the SEC’s response.